GST NEWS LETTER DATED 02/01/2019 – PROPOSED CHANGES AFTER GST COUNCIL MEETING ON 21/12/2018.

This newsletter is being sent to update you regarding the various changes which are made effective from 31/12/2018 or 01/01/2019 as mentioned in the respective Notifications. Some of the important changes of generic nature and applicable to all the assessee’s are summarized below;

- Waiver of Late Fees:- The CBEC vide Notification Nos. 75/2018-CT, 76/2018-CT & 77/2018-CT all dated 31/12/2018, has waived late fees for filing GSTR-1, GSTR-3B & GSTR-4 respectively for the period July 2017 to September 2018, if the same is filed between the period starting from 22/12/2018 to 31/03/2019.

[→ Observation:- The notifications refers to waiver of late fees for the assesses who have not file the returns for the period July 2017 to September 2018 and who files between 22/12/2018 to 31/03/2019. However it is silent as to waiver for the assesses who have already filed the returns along with late fees. It is our opinion that if the amount of late fees paid is substantial then the assessee should contemplate regarding filing of Refund claim in lieu of the said notification. You may contact our office.]

- Amendments in CGST Rules:-

[ vide Notification No. 74/2018 – CT dated 31/12/2018]

- Proviso has been added in Rule 46, 49, 54(2)(a) & 54(4)(b) to provide that Signature or Digital Signature of the Authorised Representative is not required, in case an Electronic Invoice is issued in accordance with Information Technology Act 2000.

- In Rule 89(5) [i.e. refund on account of Inverted Duty Structure] an existing explanation clause has been substituted to provide that the term “Adjusted Turnover” & “Relevant Period” shall have the same meaning as provided under Rule 89(4)[i.e. as in case of Zero Rated Supply.]

- In Rule 96(1)(a) [i.e. Refund of Integrated Tax paid on Goods or services Exported out of India] the words “A Departure Manifest” has been inserted as relevant document for filing refund application in case of export of goods and services on payment of IGST.

- Rule 101 of CGST Rules is amended to cover Audit for Financial Year or Part Thereof.

- New Rule 109B has been inserted to prescribed procedure for issue of notice and grant of personal hearing for disposing of matters by Revision Authorities.

- In CGST Rules 138 [ i.e. E-way Bills Rules], New Rule 138(E) has been inserted to block the generation of E-way Bill on the site by the Registered Person who fails to file GST Returns for two Consecutive Tax Periods. Further powers granted to the Commissioner for relaxing the said restriction, by passing reasoned order in writing.

- Formats of Form GSTR -9, GSTR-9A and GSTR – 9C have been amended. [→Amended forms will be forwarded by our office in due course].

- Further the GST Rates for various goods and service have been reduced and certain goods and services are added into exempt categories. [→ We have separately forwarded Excel Sheet with detailed Summary of All Notifications with particulars and web link.]

- Also certain new services have been added under Reverse Charge basis on which Tax has to be paid by recipient of services. [→Additions given in table format for ease of reference.]

| 12. Services provided by Business facilitator (BF) to a banking company. | Business facilitator (BF) | A banking located in the taxable territory. |

| 13. Services provided by an agent of business correspondent (BC) to Business Correspondent (BC) | An agent of Business Correspondent (BC) | A business correspondent located in the taxable territory. |

| 14. Security Services (services provided by way of supply of security personnel) provided to a registered person: Provided that nothing contained in this entry shall apply to, (i)(a) a Department or Establishment of the Central Government or State Government or Union Territory; or (b) Local Authority; (c) Governmental agencies; Which has taken registration under GST Act 2017 only for the purpose of deducting tax under section 51 of the act and not for making taxable supply of goods or services. | Any person other than a Body Corporate | A registered person located in the taxable territory. (Inserted vide Notification No. 29/2018 – CT(R) dated 31/12/2018) |

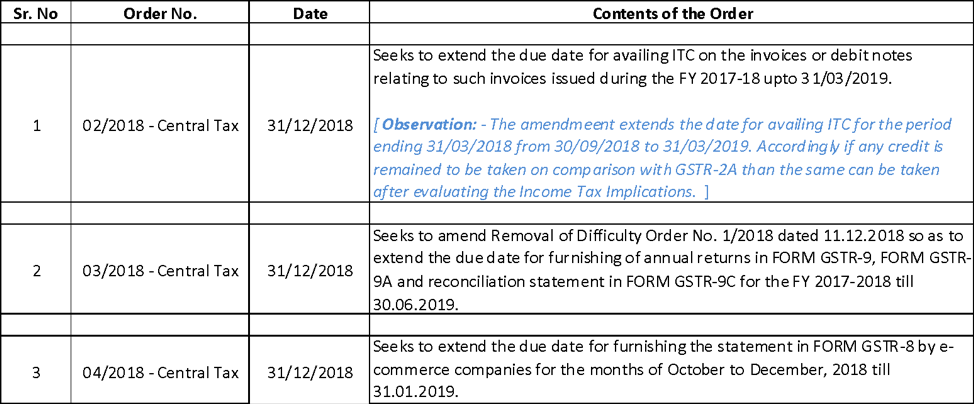

- The CBIC have issued following Removal of Difficulty Orders for removal difficulties faced by the taxpayers as under;

In case of any queries you are requested to contact our office.

Regards,

Vinay S. Sejpal

Advocate